College days are the best days of our lives, or so they say. I remember discussing this cliché with my fellow college students when I was studying psychology at university and concluding that I was indeed having a whale of a time and that I couldn’t imagine life getting any better. Now, 20 years on, I would be inclined to back up the statement even more. Having very little money was never an issue, it simply taught me to be more aware of what I was spending money on and more resourceful to make my money stretch further. It became a challenge, and one that actually enhanced my enjoyment at university.

The key for successfully managing finances, I discovered from experience, and have learned after years of working in the finance industry, is to approach budgeting enthusiastically. Worrying about where the money is going to come from to pay the bills might seem inevitable, but it is in fact counter productive. Worry leads to inactivity. Inactivity doesn’t pay bills. Presenting budgeting as a game or a personal challenge can completely alter our perspective on saving money, and rather than it being a chore, it can become a passion. Learning about the different ways to save money, and to raise money is integral to the challenge.

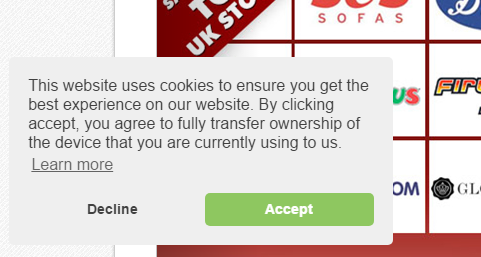

This has changed since my college days as online shopping is a key way of ensuring our money goes much further. I run this voucher code website, and have seen and experienced how effective coupons are at saving people money. There are many such websites that make the process of saving money on goods that we buy much easier. In addition to coupon sites, there are also cashback sites that offer you money in return for buying all of your goods through their site. Plus, money saving forums are a great way to pick up tips on how to save and find out what savings are available. They can also be a good place to socialise, talk about your personal circumstances and get advice from experts and people in the same boat as you. This can really relieve some of the pressure as you discover that you are not alone.

A change in financial circumstances after the age of 40 may at first seem like a step back, and that is often difficult to cope with emotionally. However, learning to budget is not the only solution to the challenge. The change can be regarded as an opportunity to earn extra money and this can open up all sorts of doors. Rather than wasting time worrying about your change of circumstances, do something positive, such as painting a picture, developing a gorgeous cake recipe, making cards or clothing, taking photographs, writing or making jewellery. Then take it one step further and try to sell your creation. Try selling to friends and family to begin with and once you have the confidence, go online. There are many shop websites and job websites that allow you to advertise your products and skills. Earning some extra cash from doing something you really enjoy doing can be so rewarding and can give you a sense of purpose. Find ways to enjoy your new life and treat it as a new beginning, rather than treating it as a step backwards, and you will find that your life will have more meaning and depth than you have ever experienced, despite having less money.